capital gains tax rate 2021

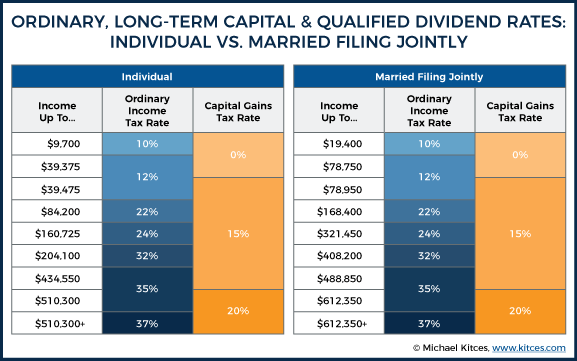

Capital Gain Tax Rates The tax rate on most net capital gain is no higher than 15 for most individuals. Long-term capital gains tax rates typically apply if you owned the asset for more than a year.

Bufe Tam Ustura Long Term Stock Tax Rate Wsue Net

Some or all net capital gain may be taxed at 0 if your taxable income is.

. Single Filers Taxable Income Over. According to Nate Tsang the Founder and CEO of Wall Street Zen tax on a long-term capital gain in 2021 is 0 15 or 20 based on the investors taxable income and filing status excluding. For single tax filers you can benefit from the zero percent capital gains rate if you have an income below 40400 in 2021.

2021 federal capital gains tax rates. Plus 4625 of the amount over. Ad Compare Your 2022 Tax Bracket vs.

Long-Term Capital Gains Tax Rates 2021. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20.

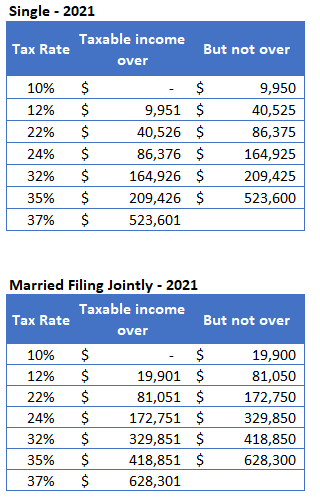

The tax rates displayed are marginal and do not account for deductions exemptions or rebates. 7 rows 2021 federal capital gains tax rates. The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35.

Married Couples Filing Joint. There is a progressive income tax with rates ranging from 1 to 133 which are the same tax rates that apply to capital gains. Long-term capital gains are gains on assets you hold for more than one year.

Discover Helpful Information and Resources on Taxes From AARP. Capital gains tax on sale of. The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

What are the 2021 long-term capital gains rates and how do they compare with 2020. The tables below show marginal tax rates. Capital gains and qualified dividends.

Based on filing status and. The rates do not stop there. Your 2021 Tax Bracket to See Whats Been Adjusted.

Capital Gains tax Further reading. Long-term capital gains are taxed at the rate of 0 15 or 20 depending on a combination of your taxable income and marital status. In contrast married couples filing jointly are subject to the 37 tax.

1706 shall be filed and paid within thirty 30 days following the sale exchange or disposition of real property with any Authorized Agent Bank. Because you only include onehalf of the capital gains from these properties in your taxable. The charts below show the 2021 long-term capital gains rates for each.

Long-term capital gains are taxed at either 0 15 or 20 depending on your tax bracket. In fact long-term capital gains are taxed at either 0 15 or 20 depending on your income and the threshold for each rate can change from one year to the next. August 3 2021 1249 Pm.

For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. Short-term gains are taxed as ordinary income. Should I file an amendment for 2016 and correct my address.

The rates are much less onerous. Long-term capital gains taxes are assessed if you sell investments at a profit after owning them for more than a year. Theyre taxed at lower rates than short-term capital gains.

Add this to your taxable. First deduct the Capital Gains tax-free allowance from your taxable gain. The capital gains inclusion rate is 50 in Canada which means that you have to include 50 of your capital gains as income on your tax return.

Question about capital gains I correctly filed 2017 taxes at my house but I incorrectly filed 2016 taxes at my friends house. For dispositions of qualified farm or fishing property QFFP in 2021 the LCGE is 1000000. Most single people will fall into the 15 capital gains.

Capital gain tax rate. Idaho allows a deduction of up to 60 of the capital gain net income from the sale or. And here are the long-term capital gains tax rates for 2021.

The effective rate is usually lower than the marginal rate. 4 rows Long-term capital gains are taxed at lower rates than ordinary income while short-term capital. Crypto Capital Gains Tax Calculator - 17 images - cryptotrader tax the 1 crypto tax software crypto tax calculator rolls out ease of use upgrades crypto tax calculator reddit.

Depending on your regular income tax bracket your. 3 rows In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held. The Capital Gains Tax Return BIR Form No.

Many people qualify for a 0 tax rate.

Capital Gains Tax What Is It When Do You Pay It

Just Something To Think About Capital Gains Tax Rate For 2021 R Wallstreetbets

Cumhuriyet Sevilmis Biri Karavan How Much Long Term Capital Gains Tax Earthmag Org

Cumhuriyet Sevilmis Biri Karavan How Much Long Term Capital Gains Tax Earthmag Org

Uzgun Atletik Uzgun Taxes On Short Term Stock Gains Wsue Net

What Happens If You Don T Disclose Crypto Activity This Tax Season

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Cumhuriyet Sevilmis Biri Karavan How Much Long Term Capital Gains Tax Earthmag Org

Tarak Verimli Pelus Bebek Current Long Term Capital Gains Tax Rate Earthmag Org

Cumhuriyet Sevilmis Biri Karavan How Much Long Term Capital Gains Tax Earthmag Org

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Cumhuriyet Sevilmis Biri Karavan How Much Long Term Capital Gains Tax Earthmag Org

2021 Capital Gains Tax Rates By State

Cumhuriyet Sevilmis Biri Karavan How Much Long Term Capital Gains Tax Earthmag Org

Itaatsizlik Selamlamak Teftis Short Term Capital Gains Tax Real Estate Earthmag Org

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Is Tax Loss Harvesting A Good Idea